PDF editing your way

Complete or edit your sf 50 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export sf 50 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your sf 50 notification of personnel action as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your sf50 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form SF-50

About Form SF-50

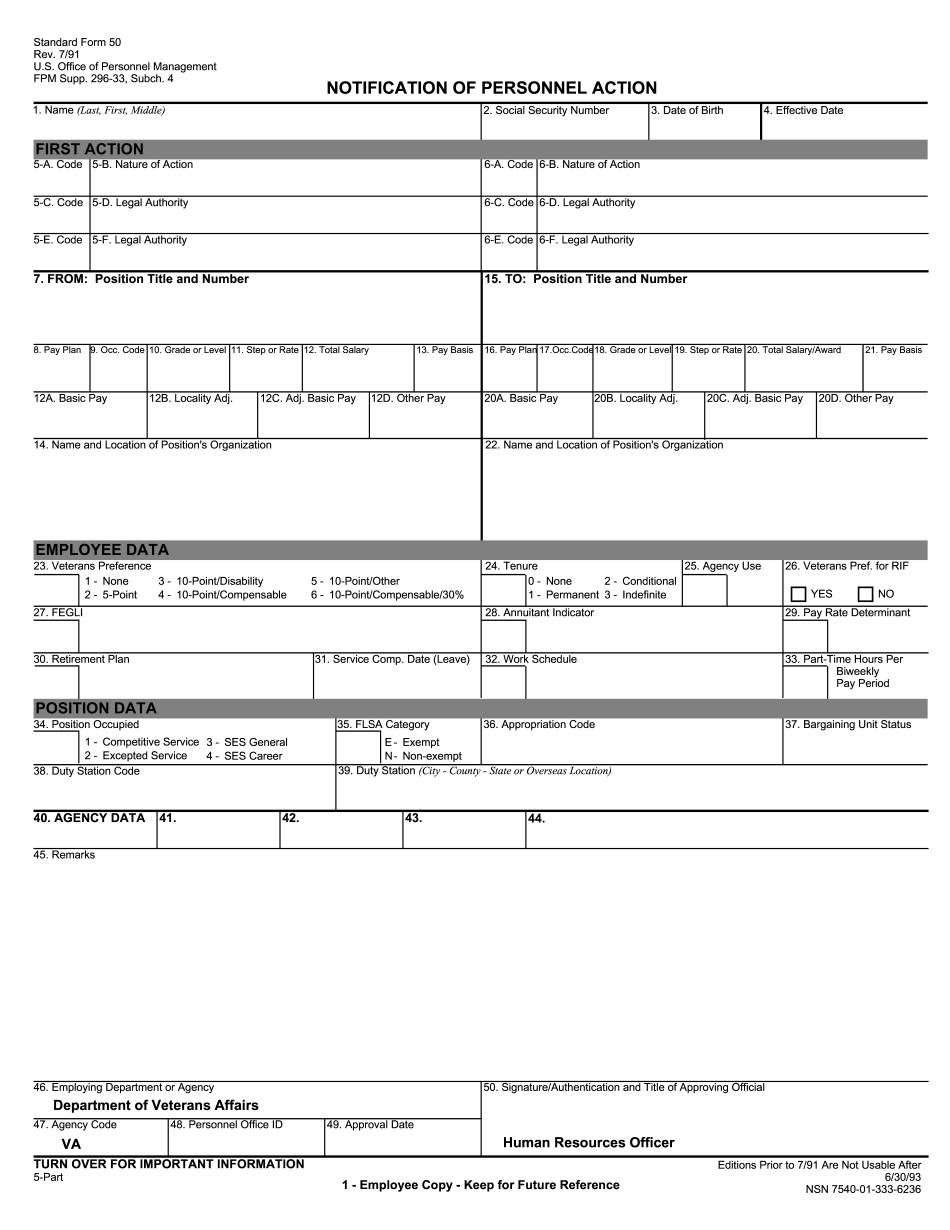

Form SF-50, also known as the Notification of Personnel Action, is a government form used by federal agencies to document personnel actions for their employees. It serves as an official record of various changes and events throughout an individual's federal employment. Form SF-50 captures details such as an employee's appointment, promotion, reassignment, transfer, conversion, separation, or any other significant action that impacts their federal employment status. It includes information about the employee, the employing agency, and the action being taken. This form is filled out and maintained by the human resources department of the federal agency. The primary purpose of the Form SF-50 is to maintain a comprehensive record of an individual's federal employment history and to provide proof of various personnel actions. It is crucial for federal employees to possess this form for different purposes, including: 1. Employment Verification: The SF-50 is often required when applying for other federal jobs or during background checks. It validates an applicant's employment history and verifies the nature of their past personnel actions. 2. Benefits and Retirement: The form is necessary for determining employee benefits, including healthcare coverage, pension plans, and retirement benefits. It establishes the length of federal service and certain entitlements. 3. Salary Verification: The SF-50 aids in verifying an employee's salary, pay grade, step increases, and other details related to compensation. 4. Employment Disputes: In case of any employment-related disputes or claims, the Form SF-50 serves as an essential document to provide evidence of past personnel actions and related employment information. 5. Resignation or Retirement: When an employee decides to leave federal service through resignation or retirement, the SF-50 documents this separation action officially. In summary, Form SF-50 is a crucial document for federal employees that tracks and documents various personnel actions throughout their federal career. It acts as proof of employment history and facilitates processes related to benefits, employment verification, salary, retirement, and other crucial aspects of federal employment.

What Is Sf 50 Form?

Form SF-50 is a Notification Of Personnel Action. It includes certain employment data that is useful to an applicant or when applying for another federal job. It is suitable for both former and current federal employees.

The Standard Form 50 is used for official recording of any changes that occurred in an individual's employment and explaining such actions. It also helps to evaluate the quality of an employer`s performance and to take a decision about his/her employment, salary and professional skills. A document is first prepared by the HR and then it is presented to an employee to check if all details provided are true and correct.

We offer you to save your time and efforts and complete a fillable SF-50 sample in PDF on this website online. Each form template is completely editable, so you may customize it according to your needs in our PDF editor. All you need is to open a needed sample and insert the requested data into fillable fields. Look through the list of information required:

-

individual`s name, date of birth and SSN;

-

nature of action and legal authority;

-

position title and number (i.e. pay plan, grade, total salary, pay basis etc.);

-

name and location of position`s organization;

-

employee data (here prveterans preference, tenure, agency use, retirement plan, work schedule, duty station etc.);

-

agency data;

-

code of employing agency, personnel office ID and date of approval;

-

signature and title of approving official.

Take advantage of signing a document electronically by typing, drawing or uploading. After a blank is completed, you can send it to a recipient straight from the website by e-mail. If required, you have an ability to convert it to other needed format.

Online options aid you to arrange your document administration and raise the efficiency of the workflow. Stick to the quick handbook to be able to entire Form SF-50, stay clear of errors and furnish it in a timely method:

How to finish a Sf 50?

- On the website using the form, click on Start off Now and go with the editor.

- Use the clues to fill out the relevant fields.

- Include your individual information and facts and contact details.

- Make certainly that you simply enter correct information and numbers in applicable fields.

- Carefully test the subject material on the form in the process as grammar and spelling.

- Refer to aid segment in case you have any problems or handle our Assist crew.

- Put an digital signature in your Form SF-50 aided by the guidance of Indicator Tool.

- Once the form is concluded, push Done.

- Distribute the completely ready kind by way of electronic mail or fax, print it out or help you save on your own gadget.

PDF editor makes it possible for you to definitely make improvements to your Form SF-50 from any net related product, customize it according to your requirements, indicator it electronically and distribute in several strategies.